Are you confident in the accuracy of the sector classification of your portfolio? Many investors are surprised to discover they may not have a clear understanding of where their investments lie. Or maybe they know that their understanding, based on traditional classification systems, is subpar. This lack of insight can have significant implications for your overall investment strategy.

By gaining a deeper understanding of your portfolio’s sector allocation, you can identify potential vulnerabilities and also opportunities that may have previously gone unnoticed. Armed with this knowledge, you can make more informed decisions about sector diversification and rotation strategies, ultimately leading to improved portfolio performance and a more robust risk assessment.

Navigating the complexities of sector exposure can be challenging, especially with factors like incomplete or outdated data, discrepancies in sector classification systems, and the dynamic nature of sectors at play. Some sectors are interdisciplinary, too, which older systems struggle to classify.

Companies with diverse business operations further complicate matters, making it crucial to accurately classify them into the appropriate sector(s). For example, popular companies like Amazon, Facebook, and Google pose a significant challenge due to their diverse business operations, making it difficult to accurately classify them into a single category and therefore many investors have portfolios full of complex sector exposure. However, traditional classification systems tend to ignore this multifaceted sector relation, and, moreover, traditional systems give no indication of the degree of relatedness.

Introducing DCSC, a new-age sector classification system designed to accurately identify and classify business activities across various industries, calculate the degree of relevance between companies and multiple sectors, and to update on a daily basis. This cutting-edge platform offers a complete solution for investors overseeing a wide range of portfolios, from small retail investors simply wanting to get in on the latest thematic trends to ETF and fund managers trying to navigate compliance requirements for their prospectuses and client expectations. With its detailed and up-to-the-minute company-sector relevance scores, the DCSC tool equips market participants to make informed decisions, mitigate risks effectively, and seize opportunities in a swiftly evolving economic environment.

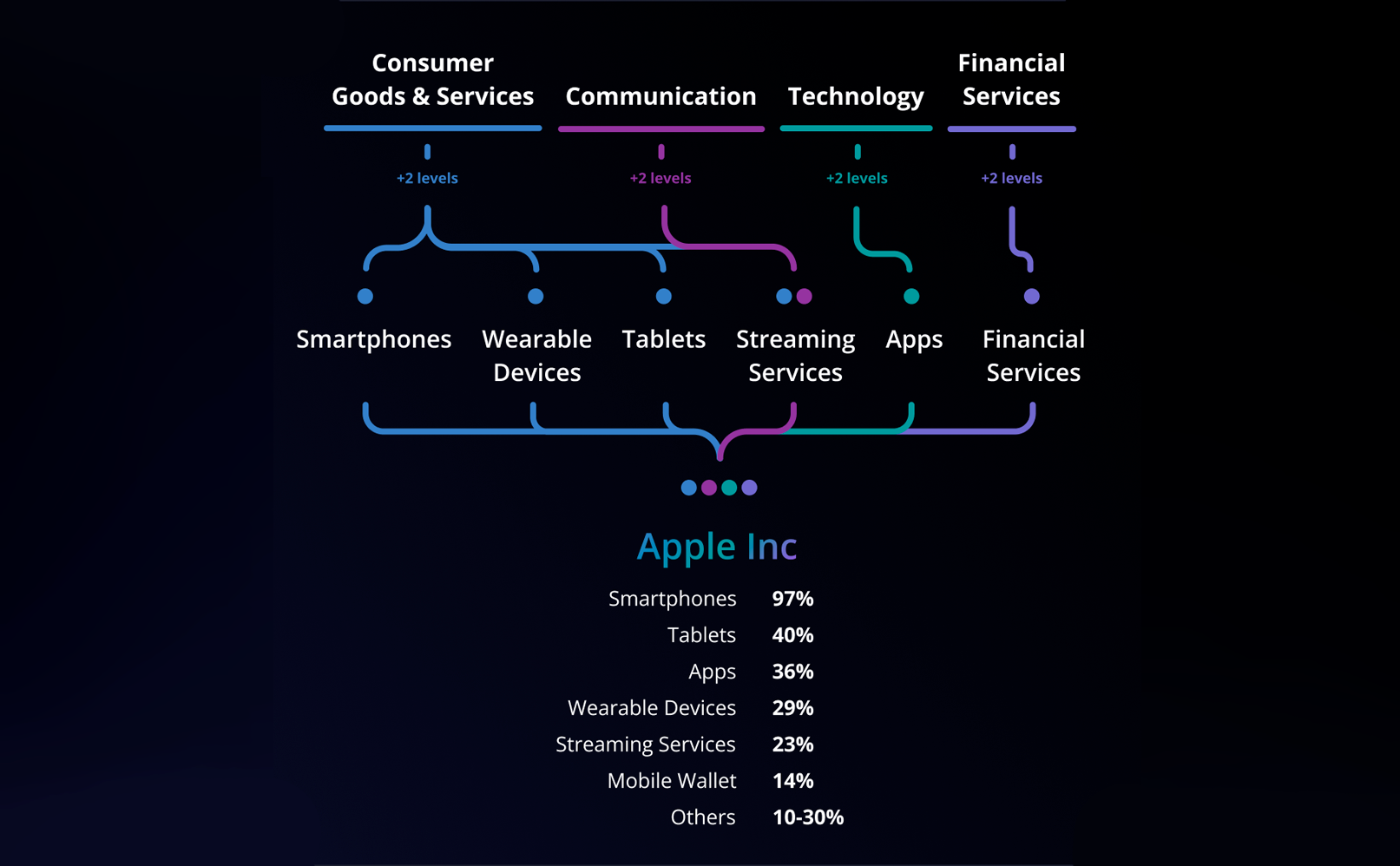

Classifying Apple and Pfizer Individually

A case study of Apple using the DCSC classification methodology demonstrates the difference between old-school classification systems and this modern approach. By applying DCSC, Apple is classified as being involved in smartphones, wearables, streaming services, mobile wallets, and several other sectors across four levels, giving us a clearer picture of its role. This multi-sector, granular classification enables investors and analysts to delve deeper into Apple’s diverse business operations and the specific sectors in which it operates, one-by-one if preferred.

By understanding Apple’s sector exposure at such a detailed level, stakeholders can make more informed investment decisions, identify potential risks and opportunities by sector, and gain a comprehensive view of the company’s strategic positioning within the market. This level of insight can be instrumental in developing tailored investment strategies, optimising portfolio diversification, and staying ahead of market trends.

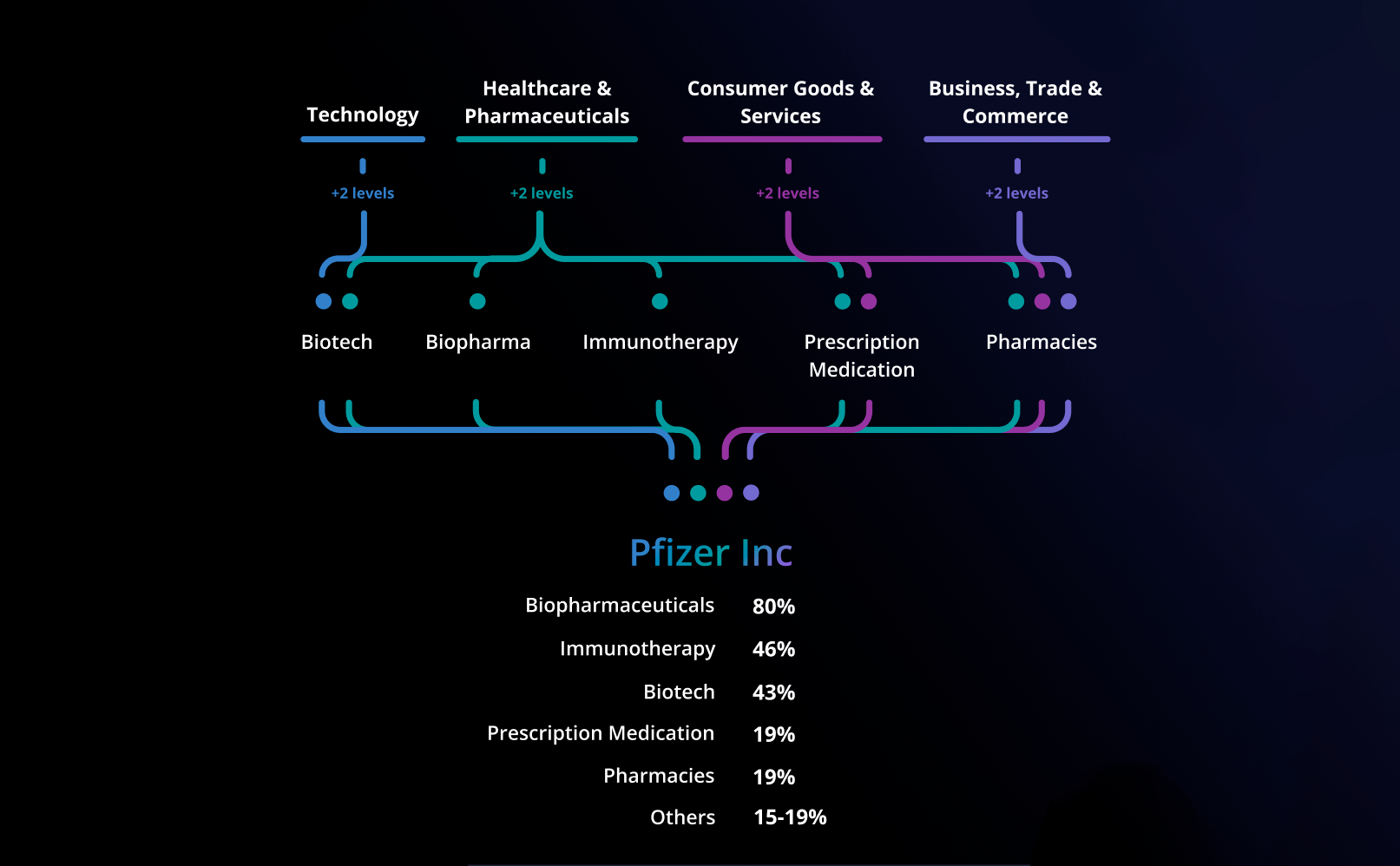

Similarly, let’s delve into the world of Pfizer, a global pharmaceutical company, to see how a detailed classification approach can shed light on its core business and products. By using the DCSC classification method, we can get a better understanding of Pfizer’s diverse offerings, including medicines, vaccines, and consumer healthcare products. This classification breaks down Pfizer’s business activities into various sectors, including Healthcare and Pharmaceuticals (95%) and Technology (24%) at Level 1. As we zoom in to Level 4, we see Pfizer’s expertise in biopharmaceuticals (79%), immunotherapy (47%), and biotech (43%) are highlighted. This detailed breakdown helps us appreciate the breadth and depth of Pfizer’s activities in sectors often overlooked by other classification systems.

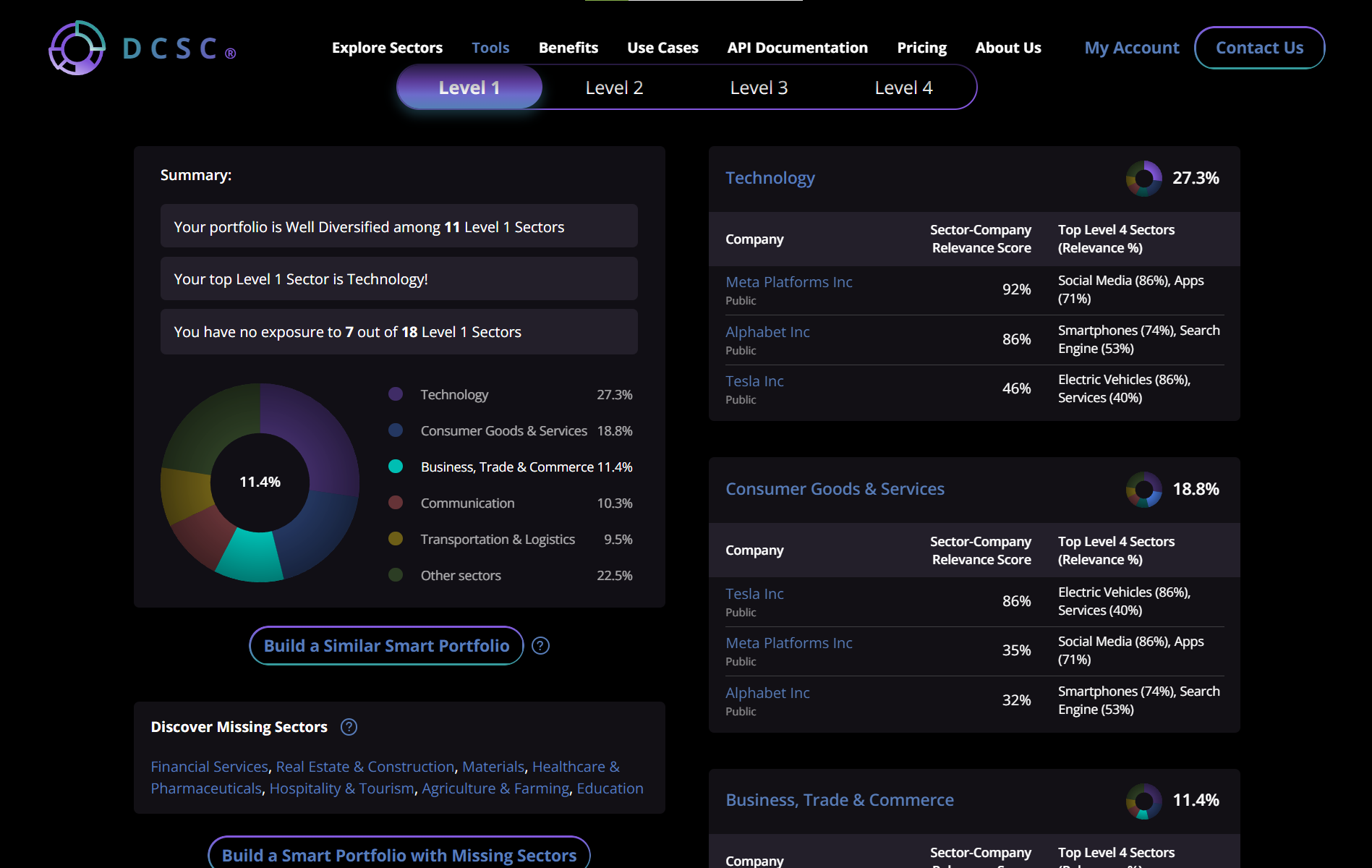

Together in a Portfolio: Tesla, Alphabet, and Meta’s DCSC Analysis

When we look at a group of companies in a portfolio, like Tesla, Alphabet, and Meta,

through the lens of the DCSC classification tool, we can see the bigger picture of where our investments stand. This trio leans heavily towards the Technology sector, while also dipping their toes into the Automotive sector. By using the DCSC classification for this mix, investors get a clearer view of where their money is going.

And with this improved view, investors can better optimise their portfolios by adjusting sector weights, reducing concentration risk, and aligning investments with financial objectives. This enables investors to harmonise their investment strategy with risk tolerance, financial goals, and market trends, enabling more deliberate investment decisions.

DCSC is like having a personal guide to the world of investing. In contrast to conventional systems, this innovative tool leverages state-of-the-art technology and up-to-the-minute data to link companies with sectors, including those that are currently most relevant and even newly emerging ones. The relevance score provides a spectrum of relatedness in contrast to the binary yes-no of older classification systems, and the concept of companies being part of multiple sectors means a truer picture of the economy than the more artificial view of older systems that only allow a single sector per company. Moreover, the use of news as one of the relevance score inputs also means a frequent update basis (daily), so changes and trends are picked up early.

DCSC is more like a personal advisor that knows the markets thoroughly than a vague tool that only sees part of your portfolio’s exposure.

Finding Emerging Sector Trends

Investors relying on older, slower classification systems were not well-positioned to take advantage of the emergence of new sectors, such as bitcoin wallets or Generative AI. Or at least not from a purely sector-theme perspective. And this is because the older systems did not include (or may still not include) niche sectors that have recently emerged. Often these new trends can stand as sectors in their own right, but other classification systems force them into an existing hierarchy.

DCSC leverages news frequency for trend identification, creating a competitive advantage in the dynamic and fast-moving realm of investing. This unique feature of DCSC enables the identification and subsequent rapid incorporation of new sectors, so investors can anticipate market shifts and take advantage of emerging opportunities while they’re still emerging. With DCSC, investors can adjust their investment strategies to align with evolving market conditions during the evolution, not 6 or 12 months later when their classification system catches up.

Making DCSC Your Newest Investment Tool

Understanding your investments and the sectors they operate in is crucial for success in the market. By embracing tools like DCSC, investors can uncover valuable insights, make well-informed decisions, and navigate risks with confidence. Take control of your portfolio, manage your exposure effectively, and let DCSC be your trusted companion in achieving your investment objectives.

The platform is intuitive, powered by AI and Big Data, and, perhaps most importantly, affordably priced. Whether you’re a small-time user who signs up directly or a multi-billion-dollar hedge fund, DCSC has a plan that fits your needs and budget.

Not sure where you fit in to the plans and licences? Contact us and we’ll help you out.

Leave a Reply