The prospect of renewed Trump-era tariffs introduces significant uncertainty into the global economic landscape. Potential sweeping changes to U.S. trade policy threaten to reshape supply chains, impact corporate profitability, and create unpredictable volatility across sectors. For investors, the critical question is: How can I understand and manage my portfolio’s exposure to these rapidly shifting trade dynamics?

Traditional sector classification systems often struggle to provide the timely, granular insights needed. This is where the Dynamic Company Sector Classification (DCSC) system offers a powerful advantage. This article provides a high-level overview of the potential tariff landscape, highlights the challenges investors face, and demonstrates how DCSC’s dynamic approach and advanced tools can help identify risks and opportunities in this fluid environment.

The Shifting Sands of Trade Policy: Understanding the Context

Recent discussions and potential actions signal a possible return to aggressive trade policies worldwide, potentially invoking measures like the International Emergency Economic Powers Act (IEEPA). The stated goals often revolve around addressing trade deficits, perceived unfair trade practices (like currency manipulation or unequal tax regimes), and promoting “reciprocity.”

This could manifest in several ways, often subject to rapid change:

- Broad Baseline Tariffs: A potential universal tariff on imports, creating a new cost floor.

- Targeted Country-Specific Tariffs: Higher “reciprocal” tariffs aimed at countries with large trade surpluses with the U.S., with rates potentially fluctuating based on negotiations or retaliatory actions.

- Product/Sector-Specific Tariffs: Levies targeting specific industries deemed strategically important or subject to perceived unfair competition (e.g., steel, aluminum, autos, potentially tech).

- Complex Exemptions & Rules: Carve-outs for specific trade partners (like USMCA nations), certain product categories (e.g., pharmaceuticals, semiconductors – though even these can be threatened), or products subject to existing tariffs.

- Retaliation Risk: Trading partners often respond with their own tariffs, adding another layer of complexity for multinational companies.

The key takeaway isn’t the specific percentage points announced on any given day, but the inherent volatility and complexity. Policies can be enacted, modified, or reversed quickly, making static analysis insufficient.

Why Sector Analysis is Crucial (But Challenging)

Trade policies can be blanket-applied to all goods from a country, but they are frequently implemented on a sector-by-sector basis. For example, tariffs on steel and aluminum have been a recurring theme, often justified on national security grounds (Trump is imposing tariffs from the executive branch instead of via Congress, leveraging Section 232 of the Trade Expansion Act which grants this authority in national emergency situations). These target specific materials, directly impacting primary producers and downstream manufacturers (like automakers or construction firms), and potentially triggering retaliatory tariffs on unrelated U.S. exports.

Analysing exposure to such sector-based policies is complicated:

- Global Supply Chains: A car assembled in the U.S. might contain steel from Canada (potentially exempt under USMCA), electronics from South Korea (facing country-specific tariffs), and interior components from China (facing high tariffs).

- Indirect Exposure: A U.S. company might not import directly from a targeted country but rely on a domestic supplier who does, inheriting the cost increases.

- Adaptation Speed: Companies react by shifting suppliers, redesigning products, or attempting to pass costs on, changing their exposure profile over time.

This complexity highlights the need for a classification system that goes beyond simple, static labels.

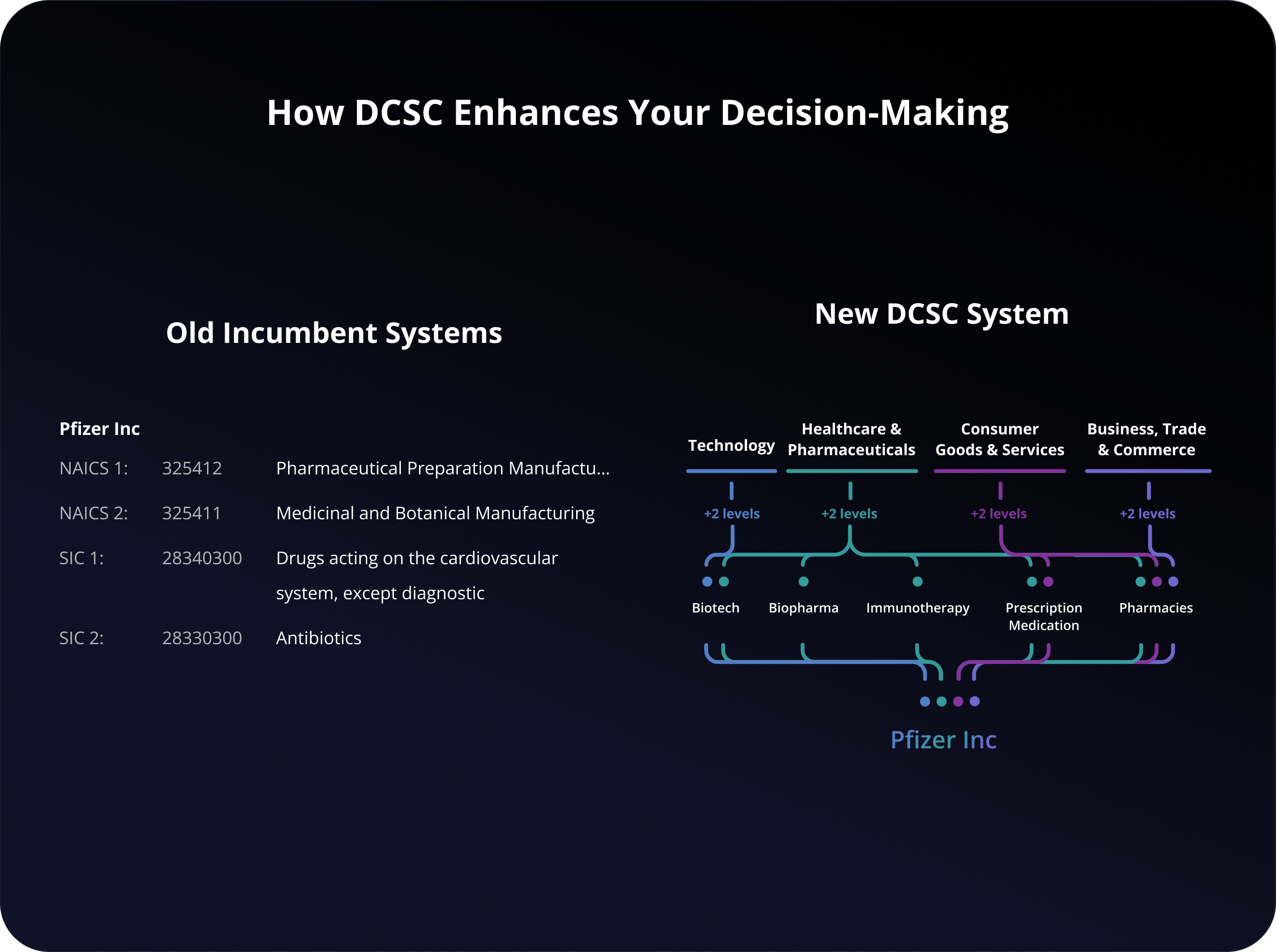

The Limits of Traditional Classification

Systems like GICS or NAICS assign companies to a single primary sector and update infrequently. While useful for broad comparisons, they fall short when analysing dynamic events like tariffs:

- They miss the multi-sector nature of modern companies (e.g., Apple is tech hardware, but also services, retail, chip design).

- They are too slow to reflect rapid shifts in strategy or supply chains driven by policy changes.

- They lack the granularity to distinguish between sub-sectors facing different tariff impacts (e.g., different types of auto parts).

DCSC: A Dynamic Approach for a Dynamic Environment

Our Dynamic Company Sector Classification (DCSC) system is designed for this kind of complexity and dynamism. It recognises that companies operate across multiple sectors and that their exposures change constantly.

Key DCSC Advantages:

Granularity (1500+ Sectors): Pinpoint exposure to specific sub-sectors potentially targeted or exempted by tariffs (e.g., differentiating “Solar Energy”, as in producers, from “Solar Technology”, as in hardware and equipment).

Dynamic Relevance Scores: AI-driven scores quantify a company’s involvement in each sector, updating in near real-time based on news, financial data, and company profiles. This captures how companies adapt to tariffs as they are implemented (or removed).

Multi-Parent Structure: Reflects reality – a company like Tesla belongs to Automotive, Energy Storage, AI, etc., each potentially affected differently by tariffs.

DCSC in Action: Identifying and Managing Tariff Exposure

DCSC’s tools provide practical ways to analyse tariff impacts:

Use Case 1: Identifying Exposure in Critical Sectors (e.g., Future Tech)

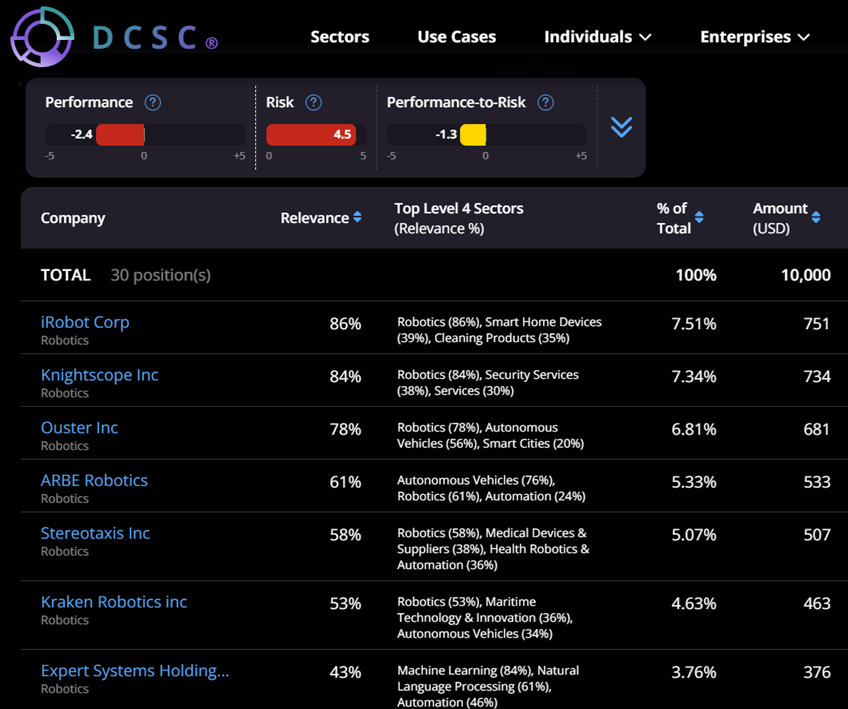

Tariffs often target or exempt strategic industries like Semiconductors or Robotics. Using DCSC’s Smart Portfolio tool, investors can identify companies highly relevant to these specific areas, regardless of their traditional classification.

A portfolio of robotics companies with hypothetical allocation, each company’s top sectors, and risk/performance metrics for the portfolio.

This helps pinpoint companies that may be impacted by focused trade measures or those benefiting from exemptions.

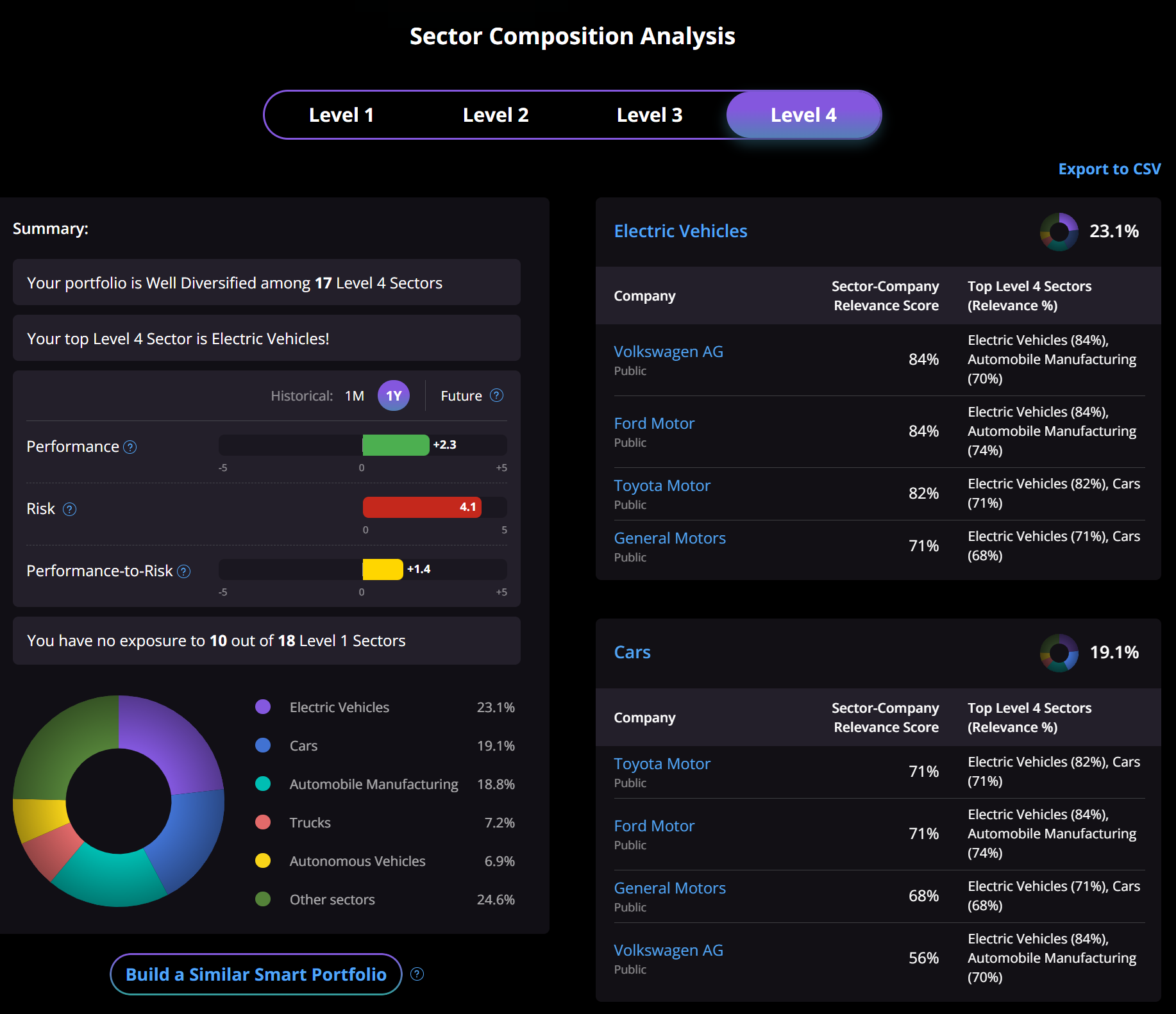

Use Case 2: Analysing Portfolio Risk (e.g., Automotive Concentration)

Consider a portfolio heavily weighted towards automakers. Tariffs on imported vehicles and parts pose a significant risk. DCSC’s Portfolio Classification tool goes beyond simply saying “high auto exposure”.

This analysis reveals nuances:

- Exposure to specific sub-sectors (EVs vs. traditional)

- Degree of reliance on or relatedness to various sectors

This detailed view helps investors understand where the tariff risk truly lies within their auto holdings and informs diversification strategies.

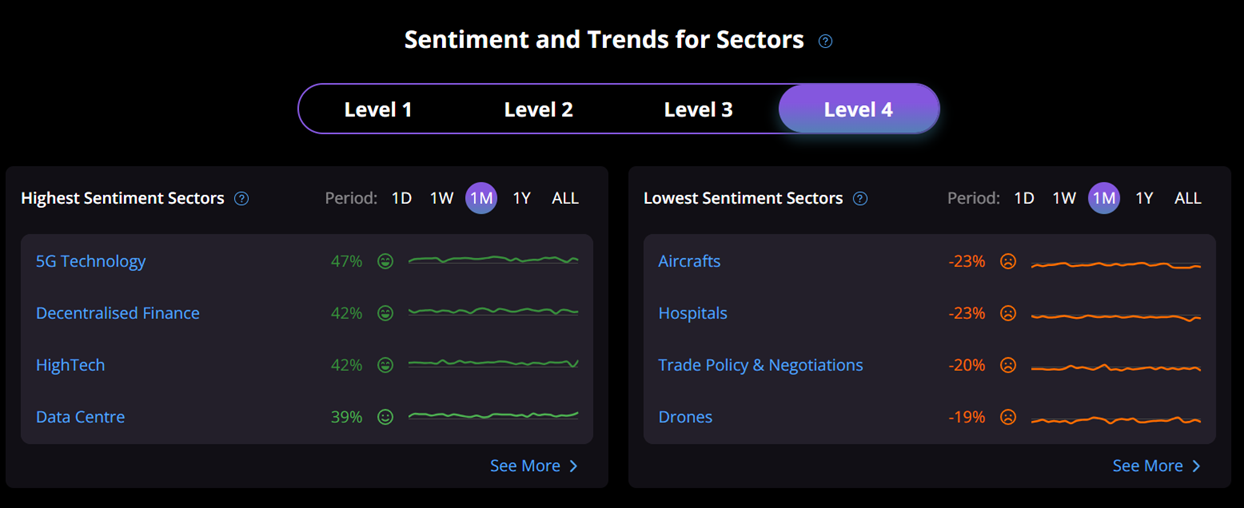

Use Case 3: Tracking Market Sentiment and Reaction

Tariff announcements and retaliations often trigger strong market sentiment shifts. DCSC’s Sector Analytics tool tracks this sentiment globally and by country.

This allows investors to:

- Gauge market reaction to tariff news in real-time

- Identify regions or sectors where concerns are highest (or lowest)

- Potentially spot divergences between sentiment and fundamentals

- Anticipate market volatility related to trade disputes

Beyond Trading: Broader Applications of DCSC

The insights from DCSC aren’t limited to portfolio management:

Exporters: Can use DCSC to identify companies in new, lower-tariff markets relevant to their products, helping them find alternative export markets.

Supply Chain Managers: Can find alternative suppliers by identifying companies relevant to specific components or materials in less risky jurisdictions.

Consultants & Policymakers: Can use DCSC’s granular data to augment models of the potential economic impact of tariffs on specific industries and regions.

Getting Started with DCSC

DCSC aims to make these sophisticated insights accessible to the general investing public with:

- Affordable Access: Plans designed for individual investors and professionals

- Ease of Use: Intuitive interfaces for portfolio analysis and sector discovery

- Real-time Data: Continuously updated relevance scores and sentiment analysis

Conclusion: Thriving in Uncertainty with Dynamic Insights

Navigating potential Trump tariffs requires moving beyond static analysis. The situation is fluid, complex, and impacts companies in multifaceted ways through their global operations and supply chains.

DCSC provides the dynamic, granular, and multi-dimensional perspective needed to understand this environment. By leveraging DCSC’s tools to analyse sector relevance, portfolio exposure, and market sentiment, investors can make more informed, data-driven decisions. Rather than reacting purely to headlines, DCSC empowers users to proactively assess risks, identify potential opportunities, and position their investments more strategically in the face of trade policy uncertainty.

Leave a Reply