Every 24 hours, enough sunlight touches the Earth to provide energy for the entire planet for 24 years” – Martha Maeda”

Thus, the energy emitted by the Sun in one day is 3.37 × 10 31 J.

As we face the urgent challenge of climate change, the energy transition has taken centre stage in global initiatives. Moving towards renewable energy and electric vehicles (EVs) isn’t just a smart choice, it’s a vital step toward meeting the carbon reduction goals necessary for achieving net-zero emissions by 2050—a target crucial for keeping global warming below 1.5°C.

The U.S. Energy Information Administration’s 2024 reports indicate that renewable energy contributes roughly 8.3% to total energy production this year. Additionally, another report highlights that renewable energy now provides over 30% of the global electricity supply, suggesting that humanity may be on the verge of reducing fossil fuel generation, despite increasing electricity demand.

Industry experts are anticipating an impressive annual growth rate of around 15-18% from 2024 to 2030, driven by new renewable technologies and decreasing costs that are making clean energy investments increasingly appealing.

China is truly leading the way in the electric vehicle movement, with an impressive 3.2 million public charging points available across the country. This extensive network, which includes 1.43 million AC chargers and 1.78 million DC chargers, has been made possible by strong government support and subsidies aimed at boosting infrastructure, particularly in cities and along major highways.

As reported by Pew Research in December 2020, the Department of Energy indicated that there were almost 29,000 public charging stations across the United States. By February 2024, this figure had risen to over 61,000 stations. Currently, more than 95% of Americans reside in counties that have at least one public EV charging station and about six in ten Americans live within two miles of a public EV charger.

Europe has made impressive progress in developing its electric vehicle infrastructure, recently crossing the milestone of 900,000 public charging points, which includes 758,668 AC chargers and 147,867 DC chargers. This growth has been remarkable, with an annual increase of 55.4% from 2021 to 2024. However, the region still faces a significant hurdle in meeting the European Union’s ambitious goal of 8.8 million charging points by 2030.

The present number of EV charging stations and their anticipated growth are strong indicators of what we can expect from the EV market in the future. Monitoring the expansion of these charging stations will provide clear predictions regarding battery and EV car usage in various regions moving forward.

Looking at investment trends, it’s clear that renewable energy offers a much better risk/return profile compared to fossil fuels, with returns from global renewable investments reportedly seven times higher.

This compelling evidence highlights the immense potential of the renewable energy transition and the electric vehicle market—not just as essential strategies for cutting carbon emissions, but also as exciting opportunities for investors eager to be part of the green energy movement. Examining current trends reveals that the EV market is undergoing substantial changes, which is also influencing several related industries, such as battery and stationery manufacturers.

Energy Storage Surge Offsets Electric Vehicle Sales Temporarily Decline

The recent slowdown in the growth rate of electric vehicle sales has primarily led to lower-than-anticipated battery volumes, heightened competition, and price reductions aimed at maintaining market shares.

Fuelled by a combination of government backing, decreasing battery costs, and an increasing consumer demand for environmentally friendly transportation, the global electric vehicle market, valued in the hundreds of billions, is set to undergo substantial transformations in the years ahead.

At the same time that the expansion of EV markets appears to be slowing down, the energy storage sector offers a hopeful perspective for long-term growth, driven by advancements in battery technology that enhance range, safety, and cost-effectiveness.

The landscape of battery demand is also shifting, with global energy storage installations—covering residential, commercial, and utility-scale applications—now making up an increasing portion of the market. This share has jumped from just 6% in 2020 to an anticipated 13% in 2024.

In other words, the demand for batteries used in stationary storage has increased considerably. Between 2020 and 2024, the ratio of electric vehicle battery demand to stationary battery demand has decreased from 15-to-1 to 6-to-1.

However, the overall outlook for lithium-ion batteries remains stable, supported by rising expectations for stationary storage solutions. This shift reflects a broader recognition of the importance of energy storage in our transition to sustainable energy.

This growth indicates that stationary storage is becoming a vital component of the battery market, expanding at a faster pace than the electric vehicle sector. Recent forecasts show a downward adjustment in expected EV battery demand for the next four years, particularly in key markets like Germany, Italy, and the U.S.

Although the market may encounter some fluctuations in the near future, the outlook remains firmly electric, presenting an attractive opportunity for long-term investments.

This rapidly changing market landscape offers a wealth of investment opportunities, not just in established companies like Tesla and BYD, which currently dominate the market, but also in the broader supply chain and related sectors, such as battery production and charging infrastructure.

Renewable Energy’s Transformative Role

As the renewable energy transition accelerates, the adoption of solar and wind power is becoming increasingly vital in reshaping the global energy landscape.

According to the International Renewable Energy Agency (IRENA) and other industry reports, the world has been adding solar capacity rapidly, with annual installations reaching significant milestones. By the end of 2022, the total cumulative installed photovoltaic (PV) capacity worldwide reached approximately 1,185 gigawatts, meeting more than 6% of global electricity demand, an increase from roughly 3% in 2019.

Projections for future growth suggest that solar capacity will continue to expand significantly due to decreasing costs, technological advancements, and supportive government policies. Furthermore, a marked increase in wind energy capacity is also anticipated, highlighting the strong momentum within the renewable energy sector.

This growth not only signifies a shift towards cleaner energy sources but also presents lucrative investment opportunities in renewable energy companies and related technologies. Investors can anticipate returns through a combination of organic growth and strategic mergers and acquisitions.

According to the International Energy Agency (IEA) global energy investment is set to exceed USD 3 trillion for the first time in 2024, with USD 2 trillion going to clean energy technologies and infrastructure. Investment in clean energy has accelerated since 2020, and spending on renewable power, grids and storage is now higher than total spending on oil, gas, and coal.

Furthermore, ongoing advancements in clean energy infrastructure, including energy storage and grid integration, are crucial for accommodating the increasing share of renewables in the energy mix. The global renewable energy market, valued at approximately USD 1.21 trillion in 2023, is expected to grow at a compound annual growth rate of 17.2% through 2030, underscoring the sector’s robust prospects.

For investors, this presents a unique opportunity to diversify portfolios while contributing to climate change mitigation and the transition to a low carbon economy. As the world moves towards net-zero emissions by 2050, the renewable energy sector stands at the forefront of this transformation, offering both environmental benefits and substantial financial returns.

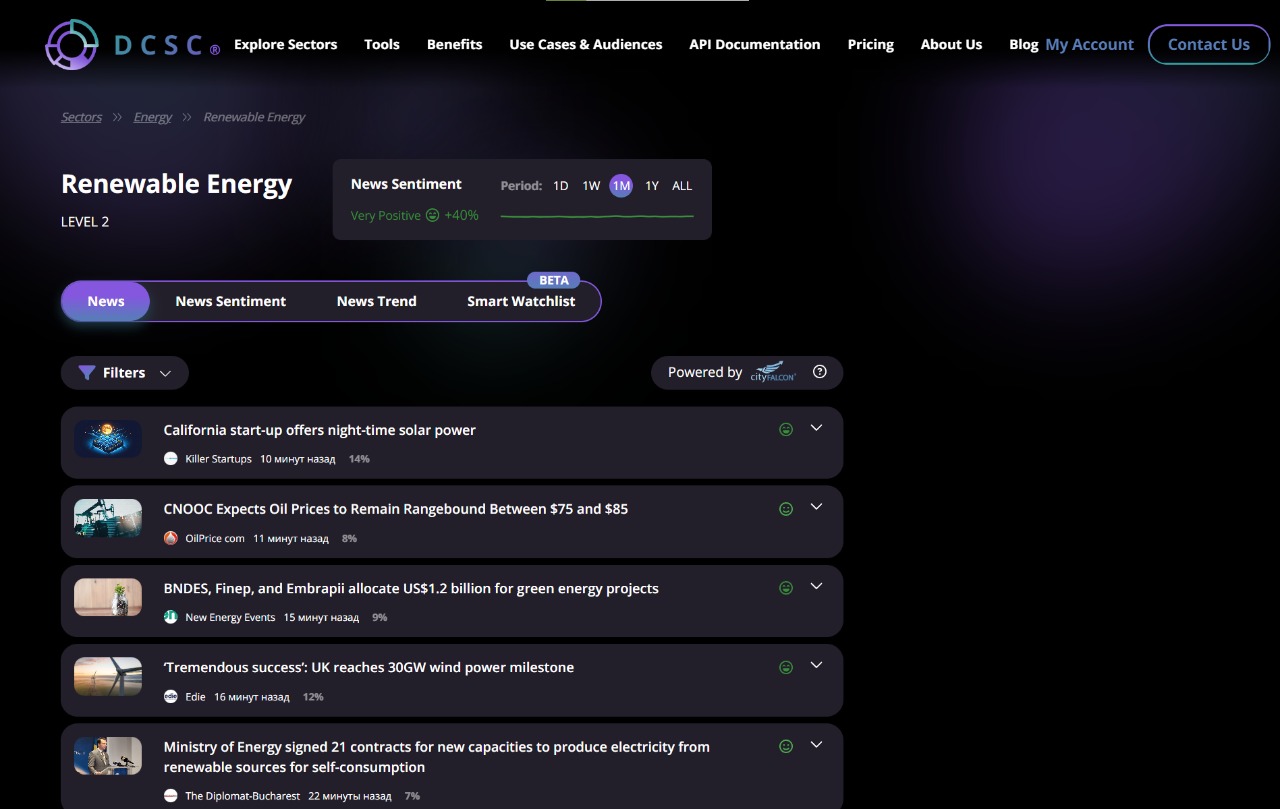

DCSC.ai: A Tool for Investors

In this rapidly evolving landscape, DCSC.ai serves as a vital resource for investors keen on navigating the complexities of the energy transition.

By harnessing cutting-edge artificial intelligence, DCSC.ai provides dynamic classifications of companies involved in this shift, helping you effectively identify and categorise potential opportunities.

DCSC.ai equips you with real-time insights to track market change developments, enhancing your portfolio management through its relevance scores for companies and sectors, which feed into portfolio builder and portfolio analysis tools. DCSC not only showcases established players but also reveals hidden gems within the renewable energy sector that may not yet be well-known but are heavily involved in the sector.

As the renewables market evolves, the need for reliable data and strategic insights has become increasingly critical. By leveraging the power of DCSC’s AI and Big Data reservoir, you can confidently navigate the investing complexities of the energy transition. Engaging with renewable energy and EV investments not only advances portfolio returns (and possibly mandated objectives for those institutional investors among our readers) but also contributes to the larger goal of fostering a sustainable, low-carbon economy.

Leading Companies in the Energy Transition

In the ever-evolving world of electric vehicles, batteries, and renewable energy, several companies are truly leading the way with their innovative approaches and impressive growth.

Take Tesla, for example: it has transformed the EV market not just by selling directly to consumers, but also through its groundbreaking battery technology, which has made electric cars more affordable and efficient. BYD is also making waves, emerging as a strong competitor not only in electric vehicles but also in energy storage solutions, showcasing a diverse strategy that gives it a competitive edge.

Manufacturers of stationary and automotive batteries such as CATL, LG Energy Solution, Panasonic, Samsung SDI, BYD, SK Innovation, A123 Systems, Northvolt, Envision AESC, and Farasis Energy are at the forefront of innovation in this sector. It may be worthwhile to consider these companies for long-term investment opportunities.

On the renewable energy front, companies like Vestas and Siemens Gamesa are at the fore, developing advanced wind turbine technologies that are key to lowering wind energy costs and boosting efficiency. These innovators are not just advancing technology; they’re also reshaping their business models to prioritise sustainability and cater to customer needs.

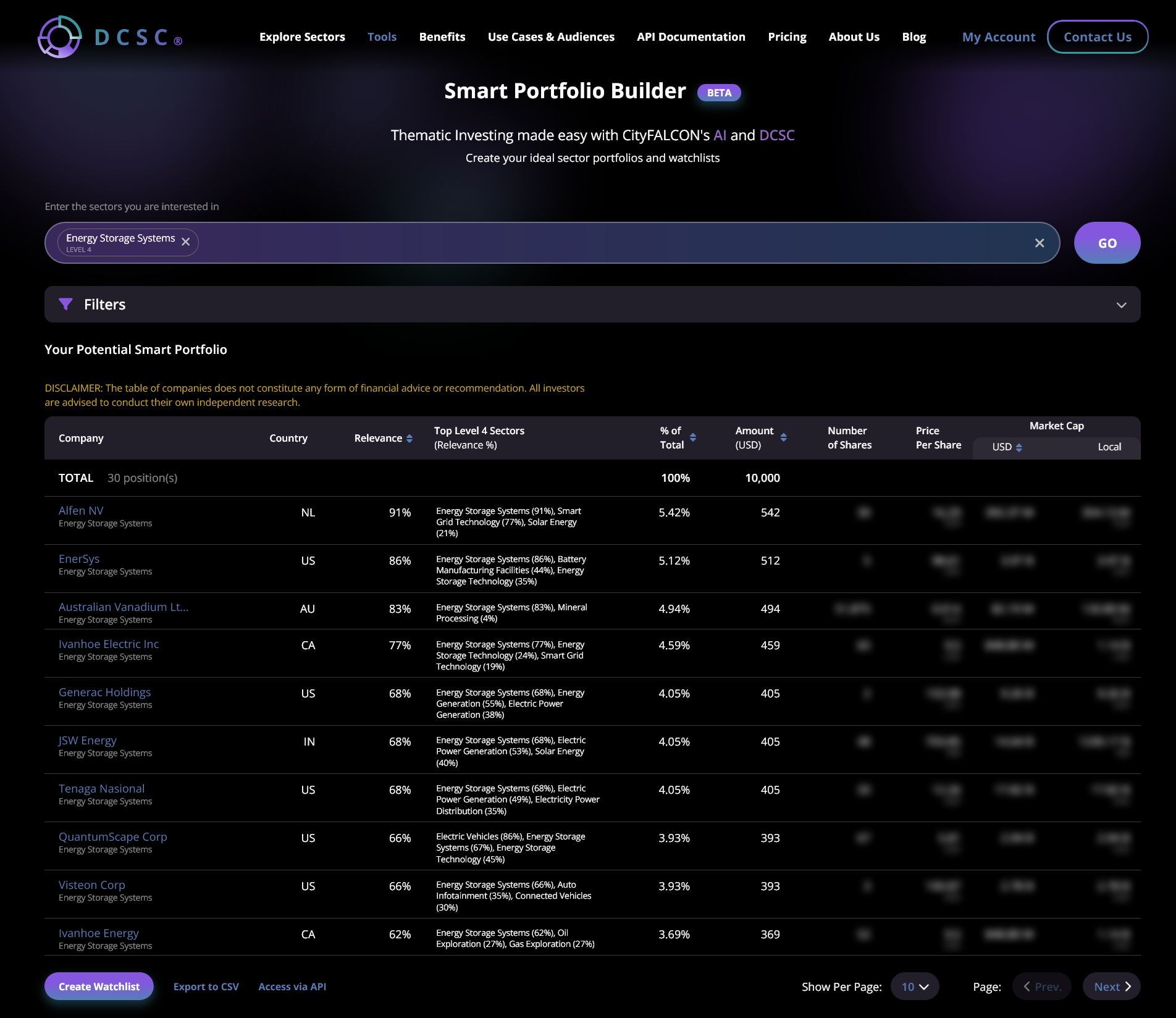

Fiinding companies, both established and niche, in sectors is very straightforward with DCSC. You can use one sector, such as energy storage systems:

Companies related to Energy Storage Systems

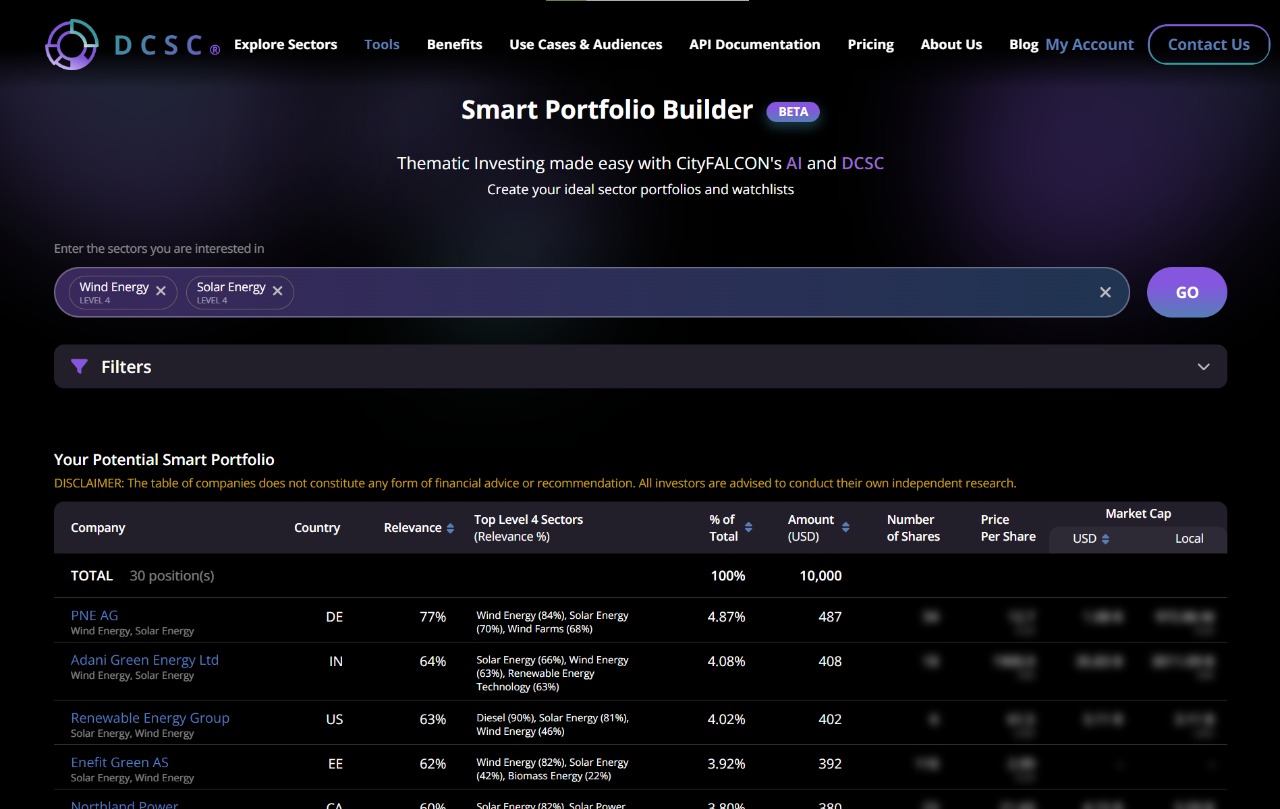

Or, alternatively, you could add multiple sectors to see which companies are involved in as many as possible. This means there are endless possibilities to combining sector-specific ideas into potential portfolios.

The investment potential in these sectors is enormous, especially as we mentioned earlier in this article the global renewable energy market is expected to soar to USD 1.21 trillion by 2030. That’s where DCSC.ai steps in, using its AI-driven dynamic company sector classification to help you discover similar new opportunities. Our technology enables you to identify up-and-coming players and evaluate their relevance in the market, making it easier to make informed investment choices.

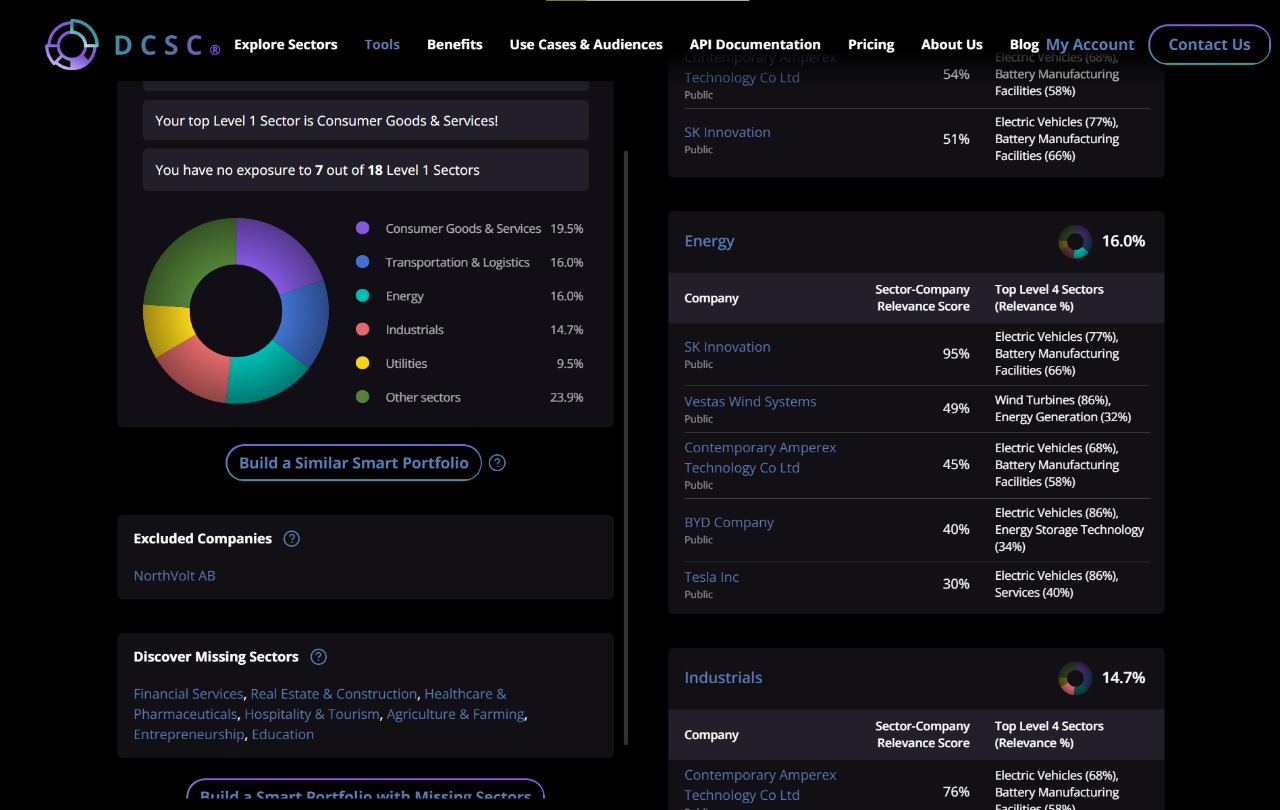

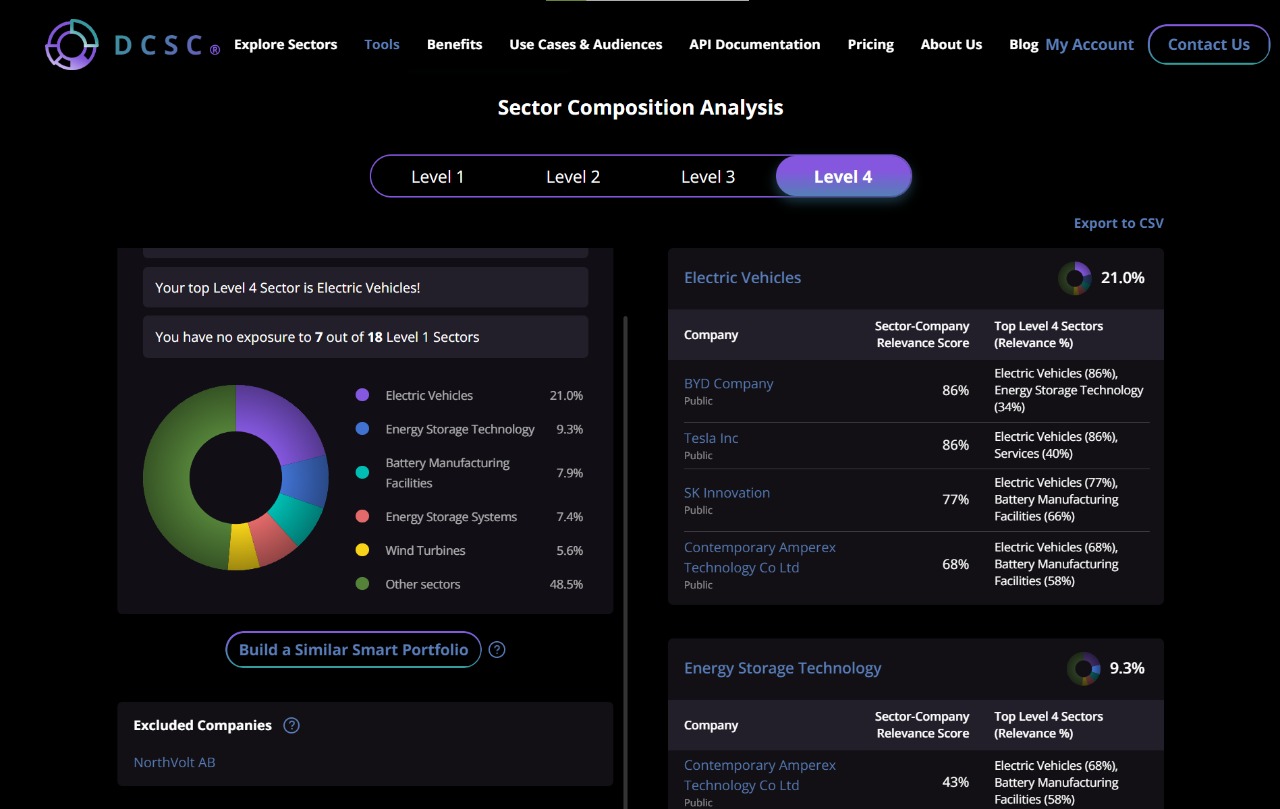

Alternatively, if you already have a portfolio, you can see how much you’re exposed to the sectors leading the way in the transition with another one of our tools. From top level sectors down to niche ones, DCSC makes it much easier to see where you’re overexposed or underexposed to important sectors.

For example, using a portfolio made up of some of the companies above, we can see the breakdown for Level 1 and Level 4:

As the EV market continues to grow, with projections suggesting that electric vehicles could make up 40% of new car sales in market-leading China by 2030, the connection between EV adoption and renewable energy innovation creates a promising landscape for sustainable investments. By leveraging insights from DCSC.ai, you can effectively navigate this changing terrain, tapping into the growth potential of both established leaders and emerging companies in the green energy revolution.

Strategic Investment Approaches in the Green Revolution

When you seek to capitalise on the exciting growth in EVs and renewable energy, having a thoughtful strategy is key. One effective approach is to diversify your investment portfolio, which helps spread risk across various areas within the energy transition. This can involve investing in solar and wind energy companies, EV manufacturers, and related sectors like battery production and charging infrastructure.

Staying well-informed is just as crucial. Keeping up with market trends, technological advancements, and regulatory changes can give you a competitive edge over time. You should also pay attention to emerging markets, like India, which is rapidly expanding its renewable energy capacity and presents a wealth of investable projects.

In this context, DCSC.ai is a valuable partner, offering real-time insights and data analysis to help you navigate the complexities of the energy transition. By harnessing advanced artificial intelligence, DCSC.ai empowers you to pinpoint promising investment opportunities and effectively track industry developments.

And a short wrapup of most influential companies in renewables, EVs, and related technologies:

Largest Producers of Electric Vehicles: Tesla, General Motors, Volkswagen, Nissan, Rivian, Ford, Lucid Motors, NIO, Daimler, Xpeng

Biggest Renewable Energy Companies: Iberdrola SA, GE Vernova, NextEra Energy, Constellation Energy Corp, Vestas Wind Systems, Jinko Solar Holding, Canadian Solar Inc., Brookfield Renewable Corp, Algonquin Power & Utilities Corp, Daqo Energy Corp

Largest Stationary Battery Manufacturers: CATL, LG Energy Solution, Panasonic, Samsung SDI, BYD, SK Innovation, A123 Systems, Northvolt, Envision AESC, Farasis Energy.

Conclusion: Embracing the Future of Energy

The shift towards renewable energy and electric vehicles isn’t just a passing trend, it’s a transformative movement that opens up exciting opportunities for you. As the world embraces a low-carbon economy, the potential for significant returns in these sectors is clear.

The combination of technological innovations, supportive government initiatives, and increasing consumer interest creates a vibrant space for investment in renewable energy and electric vehicles.

You can use DCSC and its tools to make thematic investments, such as focusing on battery manufacturers and renewable energy companies. Additionally, they can help you analyse your current portfolio to understand its sector exposures better. This can reveal intriguing insights about how individual companies are connected to various sectors, enhancing your due diligence and monitoring efforts— even for sectors that might not be your usual focus.

As we transition towards cleaner energy solutions, we not only combat climate change but also foster economic growth and enhance energy security. By investing in electric vehicles, renewable energy systems, and advanced battery technologies, we pave the way for a more sustainable and resilient future. This shift not only benefits the environment but also creates new opportunities for industries and communities worldwide, ultimately leading to a cleaner, greener, and more equitable energy landscape for the next generations.

Leave a Reply